CMS recently released the Supplemental Background on the Federal IDR Public Use File (PUF) for the first half of 2025, and the data reflects a system achieving significant gains in throughput.

At FHAS, we have tracked these trends since the portal first opened to help stakeholders navigate the complexities of the No Surprises Act. Looking back at our 2024 analysis, the themes of maturation and regulatory complexity remain, but the production velocity has increased significantly.

Record-Breaking Volume and Reducing Backlogs

According to the latest CMS reporting, the first six months of 2025 saw 1,186,812 disputes initiated through the federal portal. This represents a 39% increase over the 853,374 disputes filed in the latter half of 2024.

However, the primary development is the increased operational capacity of certified IDR entities. Case Closures are now outpacing filed cases.

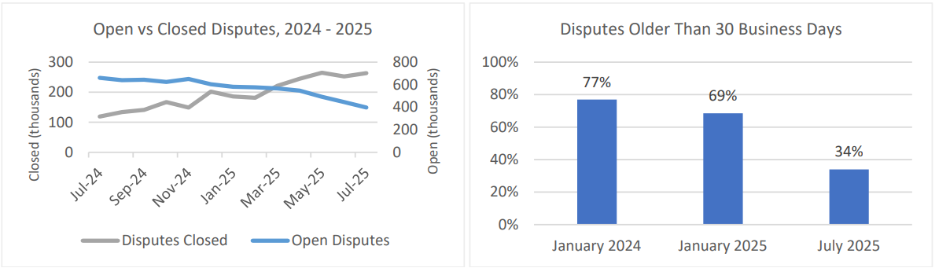

- Closures: Since July 2025, certified IDR entities have closed more disputes than were initiated each quarter.

- Output: Entities closed 1,349,343 disputes in H1 2025 — a 48% increase over the 911,088 closed in the previous six-month period.

- Backlog Reduction: By closing 14% more disputes than were initiated during this window, the system has reduced the backlog.

Accelerating Resolution Timelines

Despite the complexity of these cases, the timeline for resolution is shrinking. This improvement demonstrates the impact of refined technical processes and increased familiarity with the system.

The majority of disputes – 90% of all disputes submitted – have been resolved. And, of the 363,099 disputes still outstanding as of July 2025, only 34% are more than 30 days old.

This steady quarterly improvement suggests that as users gain clarity on the process, the system is moving toward a more predictable state of engagement.

Eligibility

The primary issue remains in the complexity of determining whether a dispute is eligible for the federal process. While non-initiating parties challenged eligibility in 40% of cases (476,117 disputes), we are seeing a positive trend toward more accurate filings:

- Ineligibility Rates Dropping: The percentage of disputes found ineligible has plummeted from 69% in early 2022 to 17% in the first half of 2025.

- Data-Driven Improvements: This decline is largely due to updated initiation forms that require supporting documentation up-front, allowing certified IDR entities to assess eligibility earlier and with greater accuracy.

Prevailing Rates and Valuation Trends

The outcomes for H1 2025 continue to show consistent patterns for those providing care. Providers, facilities, and air ambulance services were the prevailing party in 88% of payment determinations, a slight increase from 85% in late 2024.

The proportion of default decisions (where one party fails to participate) held stable at 22%. In these scenarios, providers won 91% of the time. As noted in previous reports, these defaults often arise from process breakdowns or notices being sent to incorrect contact points rather than willful non-participation.

Expert Insight on Valuations: While health plans often benchmark offers to the Qualifying Payment Amount (QPA), providers are successfully benchmarking against past out-of- network payments and historical in-network rates within the same state.

Greater Facility Engagement

We are observing a notable shift in the types of entities utilizing the IDR process. Health care facilities initiated 19% of disputes in early 2025, up from 13% in late 2024. This suggests more hospitals and ambulatory surgical centers are embracing the IDR pathway to resolve complex reimbursement issues.

Questions about implementing IDR processes or scaling your medical review operations?

Contact our team for guidance tailored to your program requirements.

Data Source Citation:

Centers for Medicare & Medicaid Services. (2025). Supplemental Background on the Federal Independent Dispute Resolution Public Use File, January 1, 2025 – June 30, 2025. Retrieved from https://www.cms.gov/nosurprises/policies — and — resources/reports

Legal Disclaimer

The information contained in this content piece is for general informational purposes only. While we strive to ensure the accuracy and completeness of the information presented, we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability with respect to the content or the information, products, services, or related graphics contained in the content piece for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The content of this page is subject to change without notice. The information provided in this document does not constitute legal or other professional advice, and is non-binding upon FHAS and any federal government agencies.