Accelerating Resolution Timelines

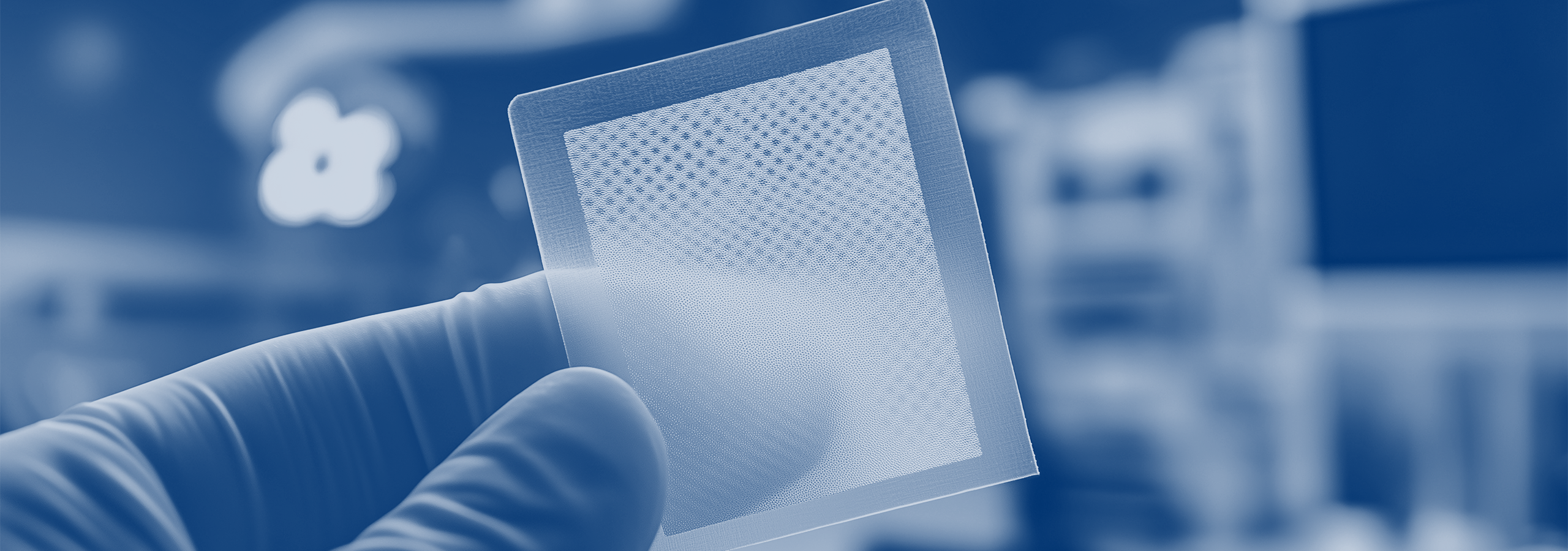

The wound care industry is facing a massive regulatory correction. After years of explosive growth, the Centers for Medicare & Medicaid Services (CMS) and the Office of Inspector General (OIG) have turned their focus toward skin substitutes — biological and synthetic materials used to treat chronic wounds.

FHAS’ role in the medical review process allows us to see the high stakes of this shift. While providers often feel the “whiplash” of changing policies, the current environment is driven by a critical need for clinical consistency and fiscal responsibility.

The Fiscal Reality: $1,000 per Square Centimeter

The crackdown stems largely from staggering data in a recent HHS-OIG report [1]. Medicare Part B spending on skin substitutes skyrocketed from roughly $256 million in 2019 to over $10 billion in 2024 [2].

The OIG’s concerns are rooted in three major factors:

- High Unit Costs: Many single-use skin substitutes can cost over $1,000 per sq cm.

- Usage Patterns: Reviewers are seeing cases where these products are applied to wounds exceeding 100 sq cm, often weekly for 12 weeks or longer [1].

- The “Spread” Incentive: OIG noted that providers often purchase products at prices significantly lower than the Medicare reimbursement rate, creating a financial incentive to choose the most expensive options [2].

A Categorized Approach: Not All Products are Equal

It is a common misconception that all skin substitutes are now facing a wall of denials. In reality, the review landscape is becoming more categorized.

- Amniotic and Placental Membrane Products: Currently, these products are under the most intense scrutiny. Many are being evaluated as “investigational” or “not reasonable and necessary” for routine chronic wound care under the Social Security Act Section 1862(a)(1)(A) [3].

- Bioengineered Skin Substitutes: Unlike placental products, certain bioengineered grafts still have established coverage pathways. For example, Novitas’ LCD L35041 (and associated LCA A54117) provides specific requirements for treating lower extremity chronic non-healing wounds.

For these products, payment is still possible, but it requires meticulous documentation showing that conservative wound care failed for at least four weeks prior to application.

Inside the Review Process: The Drive for Consistency

When Medicare contractors manage a significantly larger number of appeals involving the same billing codes or hospitals, they must ensure their decisions are both clinically sound and legally defensible.

Reviewers do not simply use “auto-denial” templates. Instead, they follow specialized clinical guidance—often informed by both CMS directives and legal counsel—to ensure that every case is evaluated with the same level of due diligence. Included within the evaluation is the careful review of specific, relevant medical documentation. This coordinated logic is essential to withstand scrutiny at the Administrative Law Judge (ALJ) stage, where appellants frequently challenge the consistency of medical necessity determinations.

Documentation Is Critical

To protect against denials, providers must move beyond just “ordering” a product. They must document:

- Failure of Conservative Care: Clear evidence that standard treatments were attempted first.

- Clinical Rationale: Why a specific product (especially a high-cost one) was chosen over a less expensive, bioengineered alternative.

- Measurable Progress: Documentation that the wound is responding to the treatment in a way that justifies continued application.

The Bottom Line

The era of “automatic” reimbursement for high-cost skin substitutes is over. As Medicare seeks to rein in billions in spending, FHAS remains committed to providing clarity on the evolving standards used by Medicare Contractors to ensure that appropriate care remains accessible while fraud, waste, and abuse are mitigated.

References

- [1] HHS-OIG Report, “Medicare Part B Payment Trends for Skin Substitutes Raise Major Concerns About Fraud, Waste, and Abuse,” Oct 2025.

- [2] CMS.gov, “CY 2026 Medicare Physician Fee Schedule Final Rule (CMS-1832-F),” Oct 2025.

- [3] Social Security Act, Section 1862(a)(1)(A), “Exclusions from Coverage and Medicare as Secondary Payer.”

Legal Disclaimer

The information contained in this content piece is for general informational purposes only. While we strive to ensure the accuracy and completeness of the information presented, we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability with respect to the content or the information, products, services, or related graphics contained in the content piece for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The content of this page is subject to change without notice. The information provided in this document does not constitute legal or other professional advice, and is non-binding upon FHAS and any federal government agencies.